lake county tax bill due dates

For example 2019 taxes are payable and billed in 2020. Office of the Lake County Tax Collector 320 West Main Street Tavares Florida 32778 Phone.

Gateway Mortgage Client Appreciation We Are Collecting Food For The Utah Food Bank When December 1s Utah Food Bank Non Perishable Foods Client Appreciation

The website does not show payments made after the 111021 due date.

. THE LAKE COUNTY TREASURERS OFFICE IS OPEN TO THE GENERAL PUBLIC. Make sure the tax year is set to the right year. You will receive a statement with upcoming due dates in the Spring.

Due dates for property taxes. Welcome to the Lake County Treasurers Office. 6686076 email addresses are public.

Wednesday July 20 2022 Last Day of Payment of 2nd Half of 2021 Taxes. THE REAL ESTATE TAX BILLS THAT ARE DUE FEBRUARY 16 2022 HAVE BEEN MAILED. A convenience fee will be charged by Lake County for each tax receipt paid with a credit card in accordance with Montana Codes Annotated 7-6-617This fee will be charged anytime a credit card is used when paying in person by phone or online.

The other 50 percent is due by Aug. Lake County IL 18 N County Street Waukegan IL 60085 Phone. Notice is hereby given that Real Estate Taxes for the First Half of 2021 are due and payable on or before Wednesday February 16 2022.

Electronic Payments can be made online or by telephone 866 506-8035. Disable your popup blocker and click Go A copy of your tax bill will appear in a new tab. While taxpayers pay their property taxes to the Lake County Treasurer Lake County government only receives about seven percent of the average tax bill payment.

Current year taxes are due by November 30th. IT IS THE RESPONSIBILITY OF EACH PROPERTY OWNER TO SEE THAT THEIR TAXES ARE PAID AND THAT THEY DO INDEED RECEIVE A TAX BILL. 15 penalty interest added per State Statute.

3 penalty interest added per State Statute. Lake County Auditor 601 3rd Ave Two Harbors MN 55616. OFFICE CLOSED MONDAY FEBRUARY 21ST IN OBSERVANCE OF PRESIDENTS DAY.

Last day to submit changes for ACH withdrawals for the 2nd installment. The drop box is only available from when the bills are mailed through the 2nd installment due date. 2021 Taxes Payable in.

These real estate taxes are collected on an annual basis by the Lake County Tax Collectors Office. To mail your payment send check or money order made payable to Lake County Auditor to. All Dates are Subject to Change.

Skip to Main Content. Pay your County Taxes online. Second installment of real property taxes are due february 1 2022 and will be delinquent if not paid by april 11 2022.

Any payment postmarked paid online or in any other fashion must be finalized before midnight Mountain Standard Time MST on the due date to avoid delinquency and penalties. If November 30th is a weekend or holiday payment is due by the following business day. Contact Us Help.

Under the new plan only half of the first payment will be due at the time. These fees are not retained by Lake County and therefore are not refundable for any reason. By this date the Treasurer must have published all previous year delinquent real property taxes on their website.

The tax offices are working in the 2020 year which corresponds to the property tax bill property owners will receive in early May of 2021. Access important payment information regarding payment options and payment due dates for property taxes. Find out how to obtain a second copy of your tax bill if you have misplaced or not received your current tax bill.

Online payments are only available during a portion of the tax collection period. In accordance with 2017-21 Laws of Florida 119 Florida Statutes. The first installment of Lake County property taxes is due Thursday June 2.

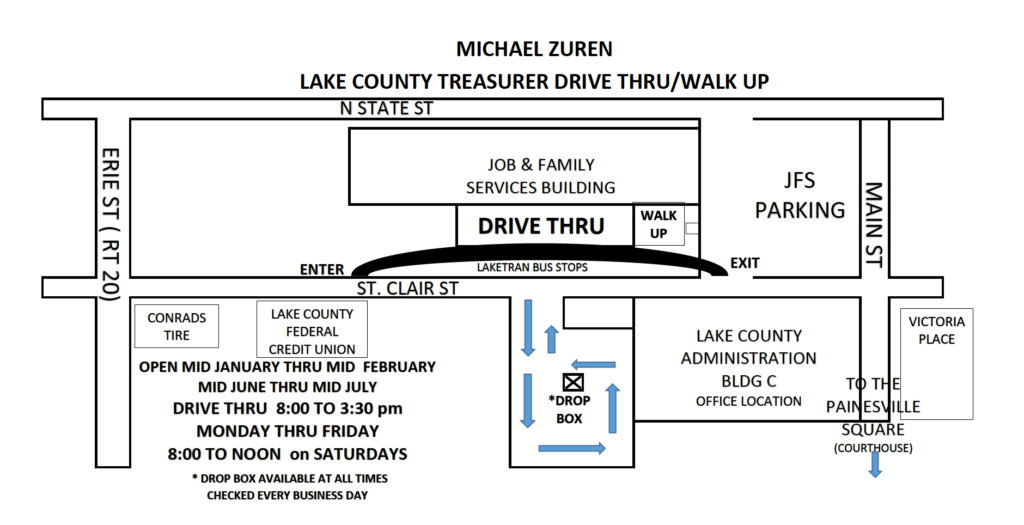

105 Main Street Painesville OH 44077 1-800-899-5253. The first installment of property tax bills is due on June 8. 2nd installment due date.

1st installment due date. ALL LENDERS TITLE COMPANIES WITHOUT THE ORIGINAL TAX BILL MUST INCLUDE 5 FOR A DUPLICATE BILL FEE PER PARCEL. The collection begins on November 1st for the current tax year of January through December.

Current property tax due dates are. Current Real Estate Tax. Main Street Crown Point IN 46307 Phone.

School districts get the biggest portion about 69 percent. Wednesday February 16 2022 Last Day of Payment of 1st Half of 2021 Taxes. If you have any questions about how much is owed on your taxes please give us a call 218 834-8315.

Tax Search Treasurer Home FAQ. Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe. Due dates for property taxes are as follows.

You will need to call the Treasurers Office for updated information at 219755-3760. May 15th first half for all real estate. CUSTODIAN OF PUBLIC RECORDS.

Delinquent taxes paid after this date are increased from a 1 late fee to a 25 penalty with a 10 minimum and interest. The second installment is due Sept. Property tax payments are made to your county treasurer.

45 penalty interest added per State Statute. The Treasurer sends out tax bills and collects and distributes funds for all Lake County taxing districts. For contact information visit.

Please note you only receive one bill in May. Check out how to pay in person for your property tax bill. Mailed payments must be postmarked no later than April 11 2022.

Jordan Lake County Tax Collector 320 West Main Street Tavares Florida 32778 Under FS. Notice Of Real Estate Tax Due Dates. Taxpayers who do not pay property taxes by the due date receive a penalty.

Property Taxes Lake County Tax Collector

Property Tax Search Taxsys Lake County Tax Collector

Mail Eve Berry Outlook Outlook Quick Cash Tax Time

Here S Who Pays The Most And Least In Property Taxes Property Tax Tax Property

Lake County Assessors Clash Over Property Value Hikes Lake County Property Values Lake

Welcome To Montgomery County Texas

Lake County To Auction 217 Tax Delinquent Properties In May Lake County Record Bee Lake County Lake Property

Cuyahoga County Home Has A 211 584 Property Tax Bill See Top Taxed Home In Each Town Cuyahoga County Property Tax County

City Of Clarksville Receives 488 000 Grant For Swan Lake Aquatic Center And Kids Splash Park Clarksville Tn Online City Hall City City Council

San Diego County Public Records Public Records San Diego San Diego County

Real Property Records Placer County List Of Jobs North Lake Tahoe

Property Tax Due Dates Treasurer

Property Tax Due Dates Treasurer