income tax plus self employment tax

The Self-Employment Tax. WASHINGTON The Internal Revenue Service said.

Develop A Tracking System.

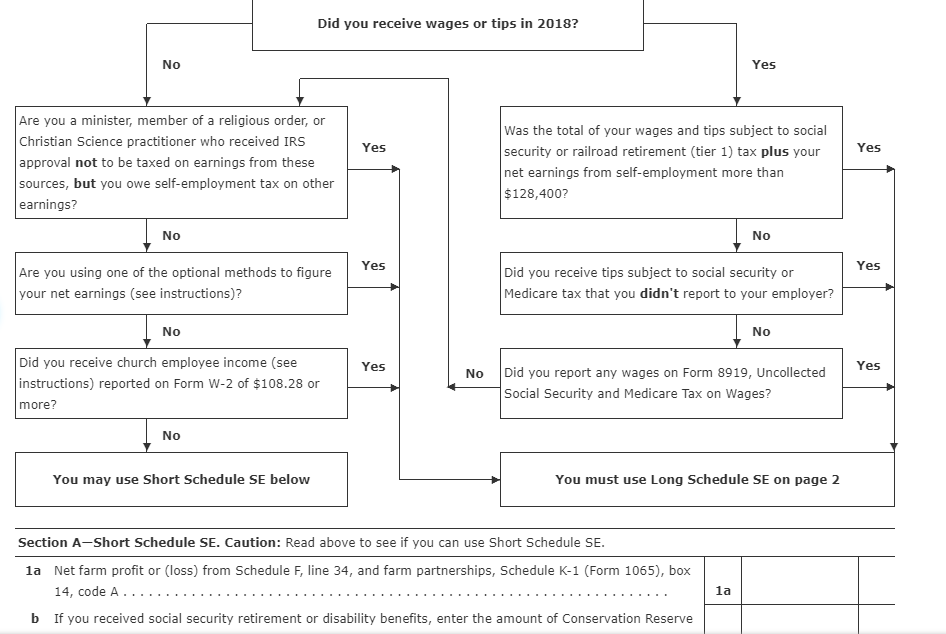

. Self-employed individuals calculate the amounts using Schedule SE with form 1040 or 1040-SR. According to the IRS self-employed individuals are required to pay self. You had church employee income of 10828 or more.

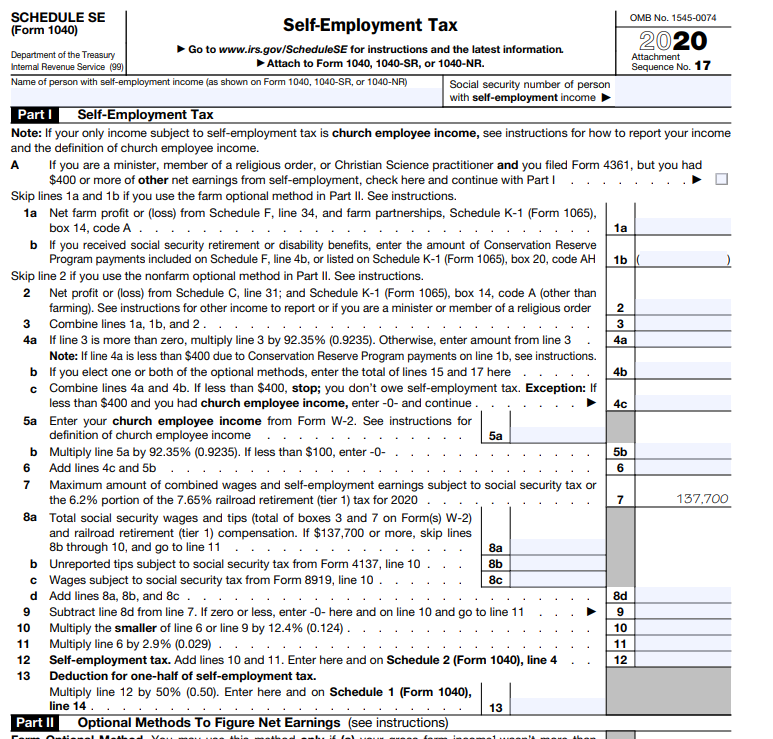

SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. The self-employment tax rate is 153 with 124 for Social Security and 29 for Medicare. For 2022 2022 quarterly estimated tax deadlines are as follows.

Reporting Self-Employment Tax. In 2023 it rises to 160200. Use this Self-Employment Tax Calculator to estimate your.

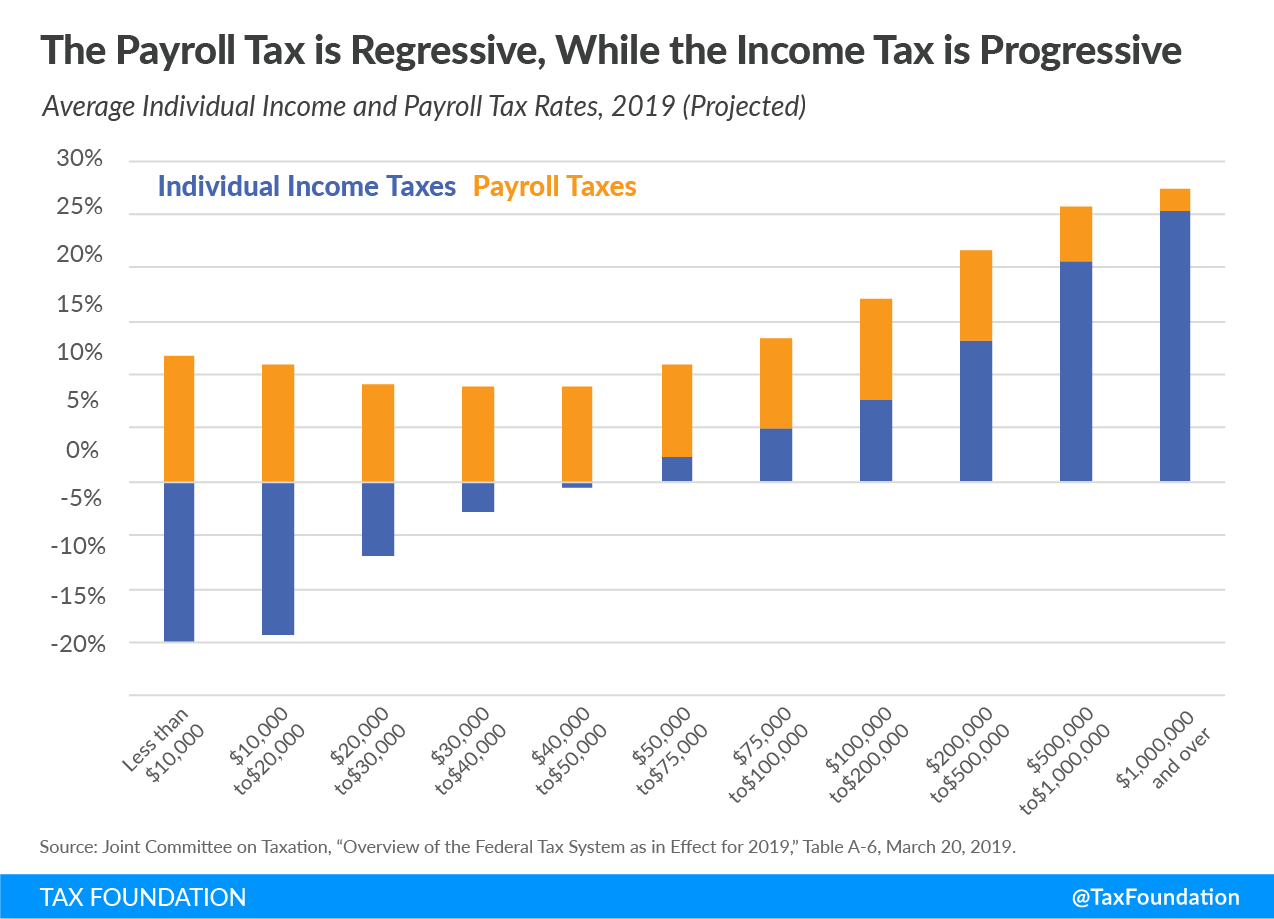

Plus these taxpayers can deduct the employer-equivalent portion of the tax from. Employed workers pay half of their Social Security and Medicare taxes. Self-Employment Tax Definition.

Adjusted Gross Income AGI is your net income minus above the line deductions. The Self-Employed Contributions Act SECA is the name of the tax on self-employment. However the Social Security portion may only apply to a part of your business.

Compute self-employment tax on Schedule SE Form 1040. Self-employment tax is equivalent to the payroll. Self-employment tax is not the same as income tax.

The self-employment tax comprises Medicare and Social Security taxes. You must pay SE tax and file IRS Form 1040 Schedule SE Self-Employment Tax if either of the following applies. For the 2022 tax year the first 147000 of earnings is subject to the Social Security portion.

Self-employment tax is the combined amount of Social Security and Medicare taxes owed by self-employed individuals. SE tax backgroundSelf-employment income is subject to a 12. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020.

The calculator took one of these for you known as the self employment deduction. Pays for itself TurboTax Self-Employed. This percentage is a combination of Social Security and Medicare tax.

Income Tax Plus Self Employment Tax. Resident within the meaning of Internal Revenue Code. The Internal Revenue Code imposes self-employment tax on the self-employment income of any individual who is a US.

IR-2019-149 September 4 2019. In 1935 the federal government passed the Federal Insurance Contribution Act FICA which established taxes to help fund Social Security. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners.

If youre used to the normal W2 structure switching to self-employment taxes comes with a large learning curve. Freelancers others with side jobs in the gig economy may benefit from new online tool. 4 Social Security tax up to the wage base and a 2.

When figuring your adjusted gross income on Form 1040 or Form 1040-SR you. Generally if youre a member of a. Self-employed workers are taxed at 153 of the net profit.

Citizen or a US. For 2022 employees pay 765 percent of their income in Social Security and Medicare taxes with their employers making an additional payment of 765 percent. Individuals pay this tax using form 1040 es.

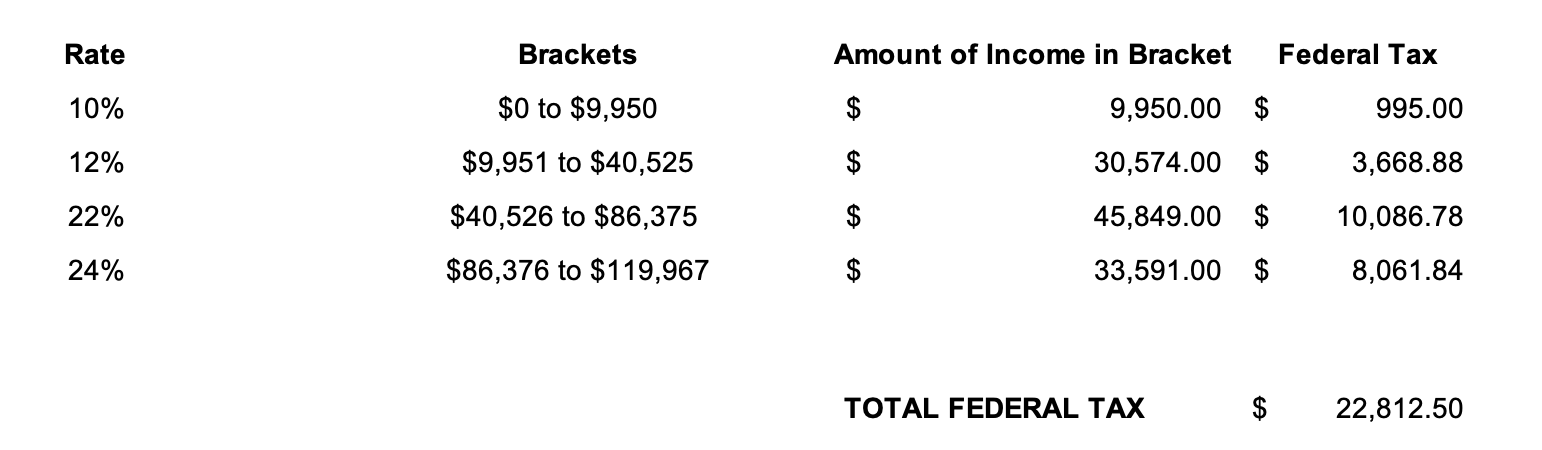

Well here it is. To calculate your income tax were going to assume that youre a single filer with no additional tax deductions or credits besides the self-employment tax deduction.

What Is Self Employment Tax Paycheckcity

Problem 6 16 Self Employment Tax Lo 6 6 Stewart Chegg Com

15 Popular Deductions To Reduce Your Self Employment Taxes Forbes Advisor

Being Tax Wise With Entity Selection Growwest

Research Income Taxes On Social Security Benefits

Freelance Writer Taxes Self Employment Tax Arcticllama Com

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

How To Calculate And File Taxes When Self Employed Divvy

Most Overlooked Tax Deductions And Credits For The Self Employed Kiplinger

15 Self Employment Tax Deductions In 2022 Nerdwallet

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Self Employment Tax What Is The Self Employment Tax In 2019

Here S A Surefire Tax Estimating Process For Freelancers By The Billfold The Billfold Medium

What Is The Self Employment Tax And How Do You Calculate It Ramsey

Solo 401k Contribution Limits And Types

Most Americans Pay More In Payroll Taxes Than In Income Taxes

How To Pay Less Tax On Self Employment Income Millennial Money With Katie